Bioenergy: Supporting a lower carbon future

Share

When people think about renewable energy, it’s usually solar, wind or hydropower that spring to mind. So, it may come as a surprise for some to learn that bioenergy, produced in a sustainable way, is also expected to be a valuable component of the energy mix to reach net zero in 2050. Moreover, that in the years ahead, its target contribution to energy supply is set to be of a similar order of magnitude as wind or solar1.

In this blog, we discuss bioenergy and its potential role in achieving zero emissions, and how in our view, it represents a significant long-term opportunity for investors.

What is Bioenergy?

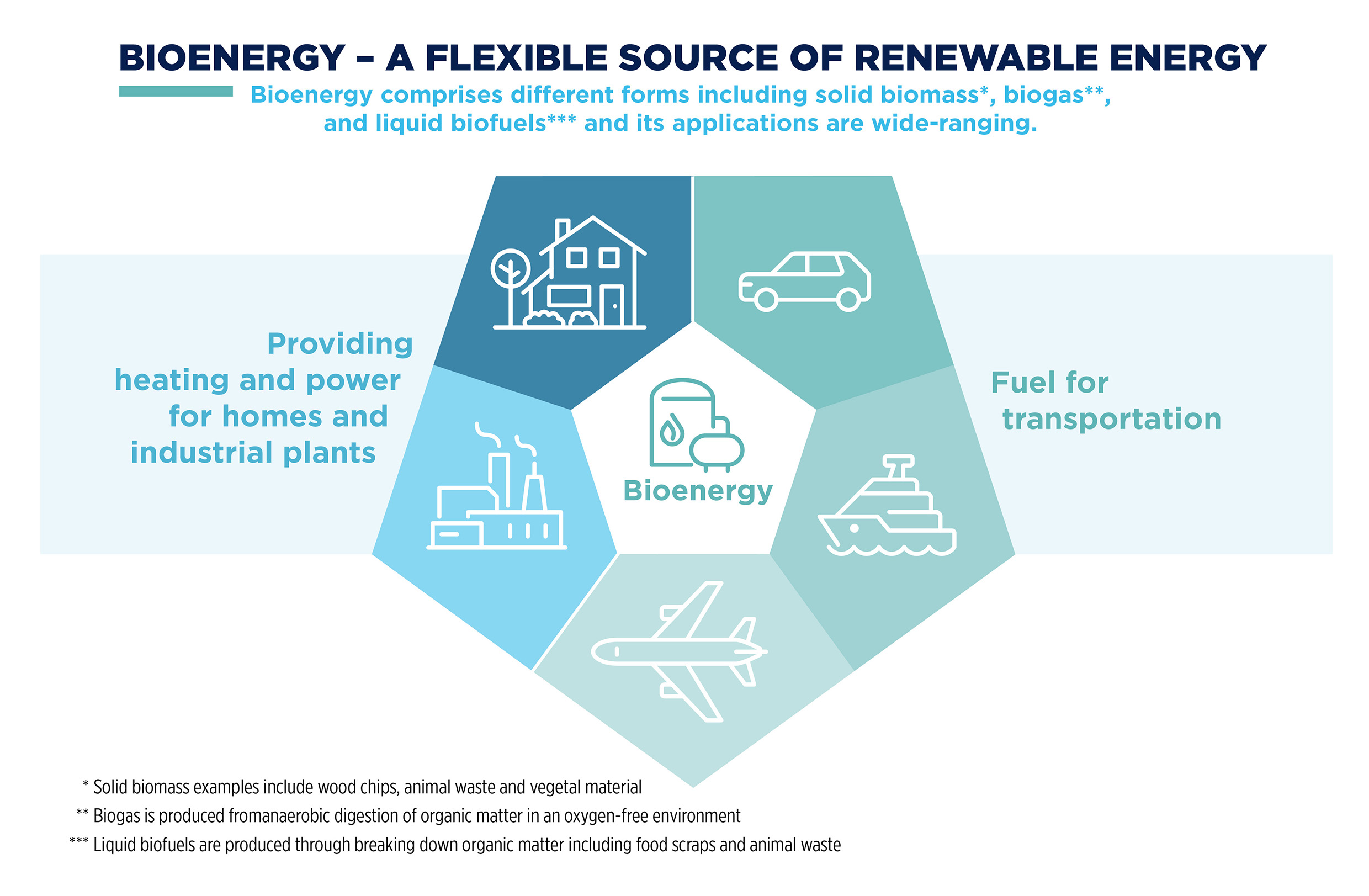

Bioenergy is a form of energy generated from burning biomass fuels, which derive from recently living organisms, primarily plants. It is extremely flexible and can be used for multiple purposes, including electricity generation, and as a fuel for transport and heating.

And it arguably ticks a lot of green boxes!

- Carbon neutral

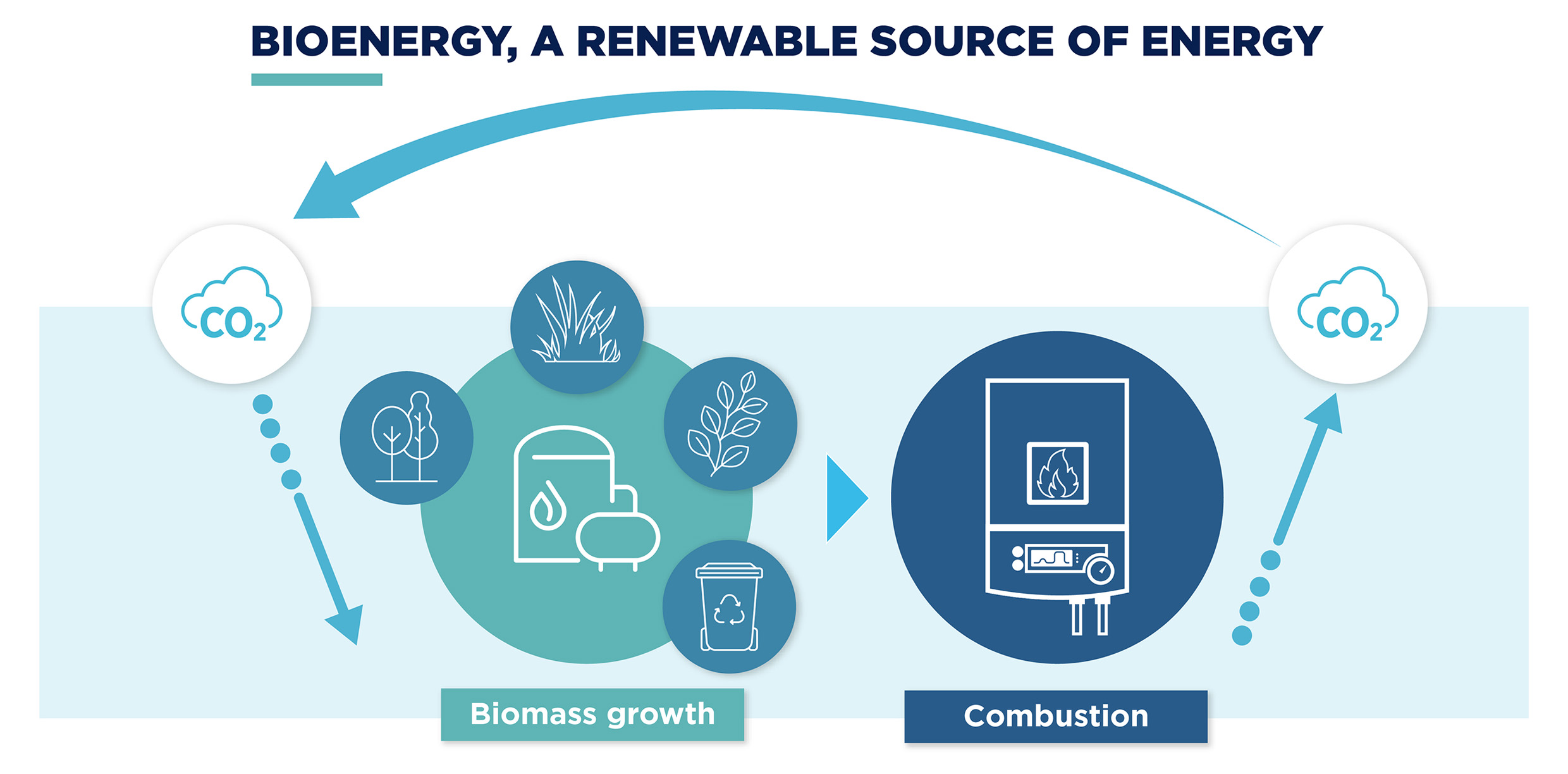

When sourced sustainably, bioenergy can be carbon neutral, using a life-cycle assessment framework, an internationally standardised methodology for assessing the environmental impact of a product over its lifecycle. This is because the carbon dioxide released during the combustion of the biomass to produce fuel is offset as plants grow in a new cycle. - Renewable

Bioenergy is considered renewable because it derives from recently living organisms, such as plants, which can be regrown relatively quickly.

- Carbon negative

It can even be carbon negative when combined with carbon capture and storage in a process known as BECCS2, as less carbon dioxide is released than absorbed over a cycle, and carbon dioxide is permanently removed from the carbon cycle. - Good for waste reduction

The ability to convert biomass waste into energy helps reduce overall waste quantities which has become a significant issue in many countries. Waste-to-energy plants have contributed to a sizeable reduction in landfill deposits and landfill gas emissions.

What’s more, bioenergy’s ability to produce energy on demand gives it a distinct advantage over other renewable sources of energy, such as wind and solar, which are intermittent.

Currently accounting for 2.4% of global electricity generation3, current forms of biomass are already far more energy efficient than natural gas, generating 230 tons of CO2 per kWh produced vs 490 tons for natural gas4.

Today, modern bioenergy accounts for around 55% of renewable energy and more than 6% of global energy supply5.

Playing an important role in reaching net zero

Given its green credentials, it’s little surprise that modern bioenergy can play a critical role in the energy transition and achieving net zero.

Notably, the Intergovernmental Panel on Climate Change (IPCC) plan for bioenergy’s contribution, as a source of primary energy, to increase from 10% today, to 18-22% in a 1.5 °C scenario by 2050. The International Energy Agency (IEA) has similar ambitions, foreseeing modern bioenergy’s contribution to meet almost 20% within the same timeframe6.

The IPCC acknowledge bioenergy as “important” to fighting climate change, describing it as “a high-value and large-scale mitigation option to support many different parts of the energy system”. Further, that bioenergy can be “particularly valuable for sectors with limited alternatives to fossil fuels (e.g., aviation, heavy industry) and production of chemicals and products”7.

No way to Net Zero without negative emissions from BECCS according to the IEA and IPCC

Bioenergy’s ability to be carbon negative via the aforementioned BECCS process – the most advanced form of modern bioenergy – is viewed as critical to achieving the “net” in net zero for both the IPCC and the IEA pathways, which are the most widely recognised.

Sustainability improving with next bio-fuel generations

There’s work to be done, though. The traditional bioenergies (often referred to as first-generation biofuels) used today are not the ones that we will be using tomorrow. First-generation biofuels include ethanol which has historically been produced from the fermentation of foods and agricultural products (e.g. beetroot, wheat, sugar, cane, corn) or biodiesel fuels primarily produced from vegetal oils (colza, sunflower, soy, palm) as well as animal oils and used oils.

These traditional biofuels are very often polluting, and harvested in a unsustainable, inefficient way, involving intensive land use.

Over time, they are to be replaced by second-generation biofuels produced from straws (annual agricultural residues), wood cellulose (forestry residues), waste products from industry, municipal solid waste or household waste (e.g. waste-to-energy to produce biomethane). Second-generation biofuels do not compete with arable land, nor require significant marginal land and have a higher energy yield per land area. In the transition phase, as new generation biofuels develop they may be blended with previous ones but should ultimately replace them.

There is even work under way on third-generation biofuels produced from marine organisms such as seagrass and microalgae, but development is still at an early stage.

Investing in a more responsible future

The global energy crisis has generated unprecedented momentum behind renewable sources of energy, including bioenergy, by exposing the world’s reliance on fossil fuels.

According to a report by the IEA, the world is set to add as much renewable power in the next five years as it did in the entirety of the past 20 years8. It is anticipated that the global bioenergy market will reach nearly USD 160 billon in terms of revenue by 2028, representing a Compound Annual Growth Rate (CAGR) of 7% between 2022 and 20289.

This of course represents a significant opportunity for investors.

Critically, the migration to modern, second-generation bioenergy is supported by public policies.

In the EU, the Renewable Energy Directive includes a cap for food-based biofuels. And there is a phase-out obligation by the 2030s for conventional biofuels that have a high land use impact. The EU green transition plan “Fit-for-55” (which targets a reduction in greenhouse gas emissions of at least 55% by 2030) strengthens sustainability criteria for biomass whilst setting binding targets for the minimum use of new generation biofuels in the Transport sector and biomass.

In the US, the Energy Independence and Security Act provides grants subsidies and loans for R&D, biorefineries that displace more than 80 percent of fossil fuels used to operate the refinery, and commercial applications of cellulosic biofuel.

Companies at the forefront of bioenergy advancements are set to play a significant role in the energy transition. This will require significant help from investors, who will not only be supporting the energy transition, but also stand to gain potentially long-term returns.

Many companies currently producing first generation bioenergy such as ethanol and biodiesel are also playing a significant role in the development of second generation bioenergy. Their existing technologies, expertise and scale may give them a competitive advantage over newer entrants and the ability to make a real difference to the energy transition.

ETF Implementation idea for consideration

Amundi Global BioEnergy ESG Screened UCITS ETF

ISIN: LU1681046006

Management fees*: 0,35%

The ETF seeks exposure to companies that generate a meaningful portion of revenue from the production, storage, and distribution of biofuels produced from plants, animal oil, and waste, or from products entering in the bioenergy value chain. It is the first ETF10 to offer an exposure to bioenergy growth, along the whole value chain.

*Management fees refer to the management fees and other administrative or operating costs of the fund. For more information about all the costs of investing in the fund, please refer to its Key Information Document (KID).

Capital at risk. Investing in funds entails risk, most notably the risk of capital loss. The value of an investment is subject to market fluctuation and may decrease or increase as a consequence. As a result, fund subscribers may lose part or all of their initial investment.

Information on Amundi’s responsible investing can be found on amundietf.com and amundi.com. The investment decision must take into account all the characteristics and objectives of the Fund, as described in the relevant Prospectus.

1. Source: International Energy Agency, Net zero 2050 (NZE) Report, 2021

2. BECCS : Bioenergies with Carbon Capture and Storage

3. Source: IPCC AR6 Report

4. Source: IPCC AR5 Report, BECCS : Bioenergies with Carbon Capture and Storage

5. Source: IEA (International Energy Agency): Tracking report — September 2022

6. Source: IEA, Net Zero 2050 (NZE) Report; TES: Total Energy Supply

7. Source: IPCC AR6 Report: Climate Change 2022- Mitigation of Climate Change

8. https://www.iea.org/spotlights/the-global-energy-crisis-has-triggered-unprecedented-momentum-behind-renewables

9. https://www.vantagemarketresearch.com/press-release/bioenergy-market-342423

10. As of 12/06/2023

Knowing your risk

It is important for potential investors to evaluate the risks described below and in the fund’s Key Investor Document (“KID”) and prospectus available on our website www.amundietf.com.

CAPITAL AT RISK - ETFs are tracking instruments. Their risk profile is similar to a direct investment in the underlying index. Investors’ capital is fully at risk and investors may not get back the amount originally invested.

UNDERLYING RISK - The underlying index of an ETF may be complex and volatile. For example, ETFs exposed to Emerging Markets carry a greater risk of potential loss than investment in Developed Markets as they are exposed to a wide range of unpredictable Emerging Market risks.

REPLICATION RISK - The fund’s objectives might not be reached due to unexpected events on the underlying markets which will impact the index calculation and the efficient fund replication.

COUNTERPARTY RISK - Investors are exposed to risks resulting from the use of an OTC swap (over-the-counter) or securities lending with the respective counterparty(-ies). Counterparty(-ies) are credit institution(s) whose name(s) can be found on the fund’s website amundietf.com. In line with the UCITS guidelines, the exposure to the counterparty cannot exceed 10% of the total assets of the fund.

CURRENCY RISK – An ETF may be exposed to currency risk if the ETF is denominated in a currency different to that of the underlying index securities it is tracking. This means that exchange rate fluctuations could have a negative or positive effect on returns.

LIQUIDITY RISK – There is a risk associated with the markets to which the ETF is exposed. The price and the value of investments are linked to the liquidity risk of the underlying index components. Investments can go up or down. In addition, on the secondary market liquidity is provided by registered market makers on the respective stock exchange where the ETF is listed. On exchange, liquidity may be limited as a result of a suspension in the underlying market represented by the underlying index tracked by the ETF; a failure in the systems of one of the relevant stock exchanges, or other market-maker systems; or an abnormal trading situation or event.

VOLATILITY RISK – The ETF is exposed to changes in the volatility patterns of the underlying index relevant markets. The ETF value can change rapidly and unpredictably, and potentially move in a large magnitude, up or down.

CONCENTRATION RISK – Thematic ETFs select stocks or bonds for their portfolio from the original benchmark index. Where selection rules are extensive, it can lead to a more concentrated portfolio where risk is spread over fewer stocks than the original benchmark.

Important information

This material is solely for the attention of professional and eligible counterparties, as defined in Directive MIF 2014/65/UE of the European Parliament (where relevant, as implemented into UK law) acting solely and exclusively on their own account. It is not directed at retail clients. In Switzerland, it is solely for the attention of qualified investors within the meaning of Article 10 paragraph 3 a), b), c) and d) of the Federal Act on Collective Investment Scheme of June 23, 2006.

This information is not for distribution and does not constitute an offer to sell or the solicitation of any offer to buy any securities or services in the United States or in any of its territories or possessions subject to its jurisdiction to or for the benefit of any U.S. Person (as defined in the prospectus of the Funds or in the legal mentions section on www.amundi.com and www.amundietf.com. The Funds have not been registered in the United States under the Investment Company Act of 1940 and units/shares of the Funds are not registered in the United States under the Securities Act of 1933.

This material reflects the views and opinions of the individual authors at this date and in no way the official position or advices of any kind of these authors or of Amundi Asset Management nor any of its subsidiaries and thus does not engage the responsibility of Amundi Asset Management nor any of its subsidiaries nor of any of its officers or employees. This research is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction where such an offer or solicitation would be illegal. It is explicitly stated that this document has not been prepared by reference to the regulatory requirements that seek to promote independent financial analysis. It does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual clients. Neither Amundi Asset Management nor any of its subsidiaries accept liability, whether direct or indirect, that may result from using any information contained in this document or from any decision taken the basis of the information contained in this document. Clients should consider whether any advice or recommendation in this research is suitable for their particular circumstances and, if appropriate, seek professional advice, including tax advice. Our salespeople, traders, and other professionals may provide oral or written market commentary or trading strategies to our clients and principal trading desks that reflect opinions that are contrary to the opinions expressed in this research. Our asset management area, principal trading desks and investing businesses may make investment decisions that are inconsistent with the recommendations or views expressed in this research.

This document is of a commercial nature. The funds described in this document (the “Funds”) may not be available to all investors and may not be registered for public distribution with the relevant authorities in all countries. It is each investor’s responsibility to ascertain that they are authorised to subscribe, or invest into this product. Prior to investing in the product, investors should seek independent financial, tax, accounting and legal advice.

This is a promotional and non-contractual information which should not be regarded as an investment advice or an investment recommendation, a solicitation of an investment, an offer or a purchase, from Amundi Asset Management (“Amundi”) nor any of its subsidiaries.

The Funds are Amundi UCITS ETFs. The Funds can either be denominated as “Amundi ETF” or “Lyxor ETF”. Amundi ETF designates the ETF business of Amundi.

Amundi UCITS ETFs are passively-managed index-tracking funds. The Funds are French, Luxembourg open ended mutual investment funds respectively approved by the French Autorité des Marchés Financiers, the Luxembourg Commission de Surveillance du Secteur Financier, and authorised for marketing of their units or shares in various European countries (the Marketing Countries) pursuant to the article 93 of the 2009/65/EC Directive.

The Funds can be French Fonds Communs de Placement (FCPs) and also be sub-funds of the following umbrella structures:

For Amundi ETF:

- Amundi Index Solutions, Luxembourg SICAV, RCS B206810, located 5, allée Scheffer, L-2520, managed by Amundi Luxembourg S.A.

For Lyxor ETF:

- Multi Units France, French SICAV, RCS 441 298 163, located 91-93, boulevard Pasteur, 75015 Paris, France, managed by Amundi Asset Management

- Multi Units Luxembourg, RCS B115129 and Lyxor Index Fund, RCS B117500, both Luxembourg SICAV located 9, rue de Bitbourg, L-1273 Luxembourg, and managed by Amundi Asset Management

- Lyxor SICAV, Luxembourg SICAV, RCS B140772, located 5, Allée Scheffer, L-2520 Luxembourg, managed by Amundi Luxembourg S.A.

Before any subscriptions, the potential investor must read the offering documents (KID and prospectus) of the Funds. The prospectus in French for French UCITS ETFs, and in English for Luxembourg UCITS ETFs, and the KID in the local languages of the Marketing Countries are available free of charge on www.amundi.com, www.amundi.ie or www.amundietf.com. They are also available from the headquarters of Amundi Luxembourg S.A. (as the management company of Amundi Index Solutions and Lyxor SICAV), or the headquarters of Amundi Asset Management (as the management company of Amundi ETF French FCPs, Multi Units Luxembourg, Multi Units France and Lyxor Index Fund). For more information related to the stocks exchanges where the ETF is listed please refer to the fund’s webpage on amundietf.com.

Investment in a fund carries a substantial degree of risk (i.e. risks are detailed in the KID and prospectus). Past Performance does not predict future returns. Investment return and the principal value of an investment in funds or other investment product may go up or down and may result in the loss of the amount originally invested. All investors should seek professional advice prior to any investment decision, in order to determine the risks associated with the investment and its suitability.

It is the investor’s responsibility to make sure his/her investment is in compliance with the applicable laws she/he depends on, and to check if this investment is matching his/her investment objective with his/her patrimonial situation (including tax aspects).

Please note that the management companies of the Funds may de-notify arrangements made for marketing as regards units/shares of the Fund in a Member State of the EU or the UK in respect of which it has made a notification.

A summary of information about investors’ rights and collective redress mechanisms can be found in English on the regulatory page at https://about.amundi.com/Metanav-Footer/Footer/Quick-Links/Legal-documentation with respect to Amundi ETFs.

This document was not reviewed, stamped or approved by any financial authority.

This document is not intended for and no reliance can be placed on this document by persons falling outside of these categories in the below mentioned jurisdictions. In jurisdictions other than those specified below, this document is for the sole use of the professional clients and intermediaries to whom it is addressed. It is not to be distributed to the public or to other third parties and the use of the information provided by anyone other than the addressee is not authorised.

This material is based on sources that Amundi and/or any of her subsidiaries consider to be reliable at the time of publication. Data, opinions and analysis may be changed without notice. Amundi and/or any of her subsidiaries accept no liability whatsoever, whether direct or indirect, that may arise from the use of information contained in this material. Amundi and/or any of her subsidiaries can in no way be held responsible for any decision or investment made on the basis of information contained in this material.

Updated composition of the product’s investment portfolio is available on www.amundietf.com. Units of a specific UCITS ETF managed by an asset manager and purchased on the secondary market cannot usually be sold directly back to the asset manager itself. Investors must buy and sell units on a secondary market with the assistance of an intermediary (e.g. a stockbroker) and may incur fees for doing so. In addition, investors may pay more than the current net asset value when buying units and may receive less than the current net asset value when selling them.

Indices and the related trademarks used in this document are the intellectual property of index sponsors and/or its licensors. The indices are used under license from index sponsors. The Funds based on the indices are in no way sponsored, endorsed, sold or promoted by index sponsors and/or its licensors and neither index sponsors nor its licensors shall have any liability with respect thereto. The indices referred to herein (the “Index” or the “Indices”) are neither sponsored, approved or sold by Amundi nor any of its subsidiaries. Neither Amundi nor any of its subsidiaries shall assume any responsibility in this respect.

In EEA Member States, the content of this document is approved by Amundi for use with Professional Clients (as defined in EU Directive 2004/39/EC) only and shall not be distributed to the public.

Information reputed exact as of the date mentioned above.

Reproduction prohibited without the written consent of Amundi